Getting The What Is Trade Credit Insurance To Work

Wiki Article

Unknown Facts About What Is Trade Credit Insurance

Table of ContentsSome Ideas on What Is Trade Credit Insurance You Should KnowWhat Is Trade Credit Insurance - The FactsExcitement About What Is Trade Credit InsuranceAll About What Is Trade Credit Insurance

This is offered by some trade finance specialists covering the potential hold-ups to payment which might come from money transfer limitations, or the bankruptcy of a government buyer. Our political threat insurance policy aids companies to safeguard their overseas financial investments in scenarios such as political violence or confiscation of assets, or various other threats relating to the actions of an international government.The costs is computed as a portion of the complete amount of income being guaranteed, starting from around 0. 15% of insurable turn over. In many cases it does exercise a lot more than this if there is imperfect credit rating or various other red flags. Similar to any kind of insurance, there is an estimation to be done around threat.

They allot each of those clients a grade that mirrors the health of their task and the method they perform service. Based on this danger evaluation, each of your purchasers is then provided a details credit report limit up to which you, the insured, can trade and have the ability to insurance claim should something go incorrect.

Little Known Facts About What Is Trade Credit Insurance.

The warranties will cover trading by domestic firms as well as exporting companies and the intent is for contracts to be in location with insurance companies by end of this month. The warranty will be short-lived and targeted to cover Covid-19 financial difficulties, as well as it will certainly be followed by a testimonial of the TCI market to guarantee it can best sustain organizations in future.It is vital to get the details right to ensure that the system benefits companies and also insurers, and also supplies value for money for the taxpayer. It is essential that insurers can keep their underwriting criteria and risk administration practices, to ensure that assistance is provided to businesses that can trade out of the existing circumstance - What is trade credit insurance.

Offered the unexpected interruption to economic activity, and also the raised risks of bankruptcy and also default in the market, profession credit score insurance companies may quickly take out a few of the insurance coverage that they presently provide in order to remain viable. The choice would certainly be to increase costs somewhat that is wasteful for all parties.

Profession debt insurance policy plays an especially significant duty in non-service sectors, such as production and building, offering businesses the self-confidence to trade with one another. The Government is keen to make sure that these industries are not take into further distress as an outcome of the Covid-19 situation. This system will certainly guarantee that supply chains continue to be protected from the possible cause and effect of trade disruption as well as company defaults.

What Does What Is Trade Credit Insurance Mean?

The final scheme is most likely to share resemblances with some of the other treatments launched across the continent. However, the details are still being settled by the UK Federal government and also being reviewed with insurance firms. Further detail will certainly be revealed in due program. The government is collaborating with industry to settle the information of the system.

The Federal government is dealing with sector to finalise the terms of the system. The Government's top priority for this scheme is to collaborate with insurers to sustain UK organizations. Additional details of the plan will certainly be introduced in due program. It is the Government's intention that this system will enable the trade credit scores market to run as regular, as for feasible.

The Definitive Guide to What Is Trade Credit Insurance

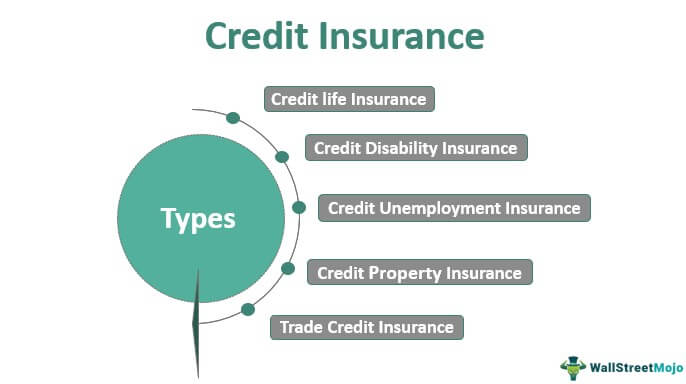

Additional details of the system will be introduced in due training course. The Government's top priority for this system is to sustain UK services that can be affected by the withdrawal of trade credit report insurance policy cover during the Covid-19 situation. In the longer term, it will certainly be suitable to review the efficiency of this intervention, assess how the marketplace reacted to economic interruption, and take into consideration exactly how it can remain to ideal serve services.Trade debt insurance policy supplies security for companies when consumers do not pay their debts owed for items or services. The policy will certainly repay the insurance policy holder in the event of the customer's non-payment, up useful reference to a certain credit rating limit established by the insurance company.

This might aggravate the financial effects of the pandemic by triggering issues for liquidity and functioning resources for purchasers as well as destructive trust in supply chains.

The sales of products as well as services are revealed to a significant variety of risks, most of which are not within the control of the vendor. The highest of these risks and about his one that can have a catastrophic influence on the stability of a provider, is the failure of a customer to pay for the products or solutions it has purchased. What is trade credit insurance.

Report this wiki page